The cost of raising a child

- 4 min read

Becoming a parent is an exciting and rewarding journey. In addition to baby-proofing your home, reading up on parenting styles and stocking up on diapers, you'll want to ensure you’re financially prepared for parenthood.

How much does it cost to raise a child?

Research by The Brookings Institution found the average cost of raising a child in the United States from birth through age 17 is $310,605.

Saving will be essential to prepare for future expenses for your kid. Financial tools like savings buckets , a feature of an Ally Bank Savings Account , can help you save over time, whether it’s for college, art supplies or a family vacation.

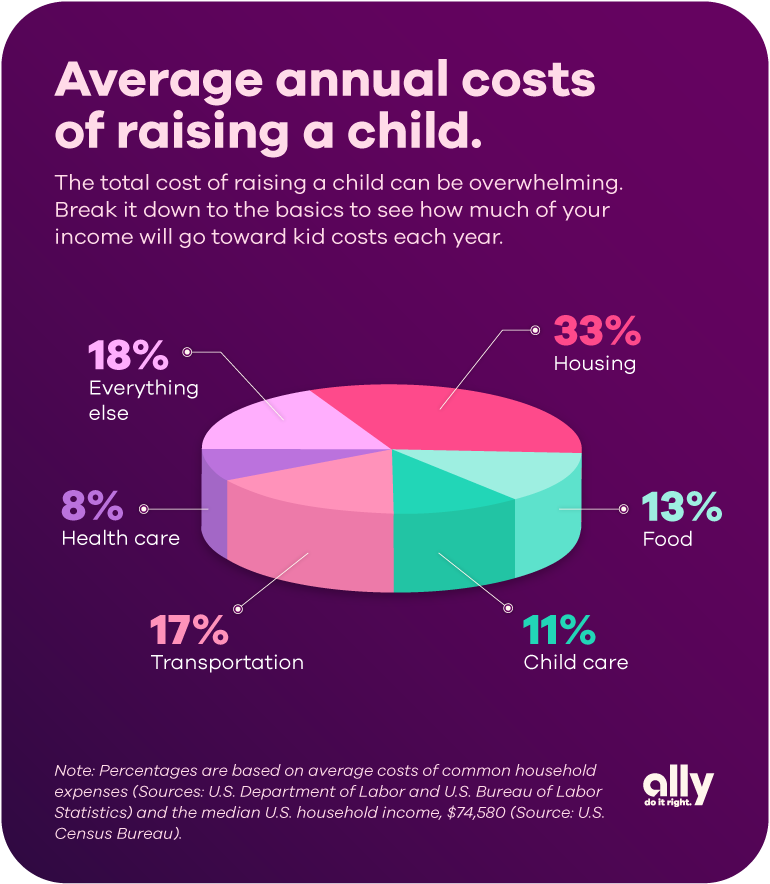

Below is a breakdown of the $300,000+ it could take to raise a child:

Housing

On average, a home accounts for about a third of household costs each year. While your payment may not change from before you had a child, you'll want to remember to factor in rent or mortgage payments, taxes, insurance, utilities, maintenance and more into your new budget when planning for the other costs of raising a child.

Food

Food costs per child, per month, can range from around $100 to just under $400 depending on your family’s lifestyle. But generally, it accounts for about 13 percent of family expenses.

Child care

This expense can vary significantly depending on how old your child is and where you live. The most recent data from the Department of Labor shows annual costs starting at more than $4,000 and going as high as $15,000+.

Insurance

Beyond these main expenses, you’ll also likely devote a portion of your budget toward insurance. Health insurance could help you defray the high cost of medical care once your child is born, and you’ll likely want to increase your car insurance coverage when your teenager begins to drive so they’re protected when behind the wheel. Life insurance can be another way to protect your family's financial security in the event of an unexpected death.

Saving will be essential to prepare for future expenses for your kid.

Education expenses

School is another significant cost for your kid(s). Even if you send your child to public school, you’ll need to consider the expenses of extracurricular activities like sports or piano lessons. And if you want to send your child to a private school, the average cost of tuition for kindergarten through high school is more than $12,000 annually.

Planning for college

For higher education , start preparing now if you can. According to research from CollegeBoard, the average in-state annual cost of tuition for a public college or university is $11,260. For out-of-state tuition, that number increases to $29,150. For private institutions, it’s around $42,000.

Ally Invest offers Custodial brokerage accounts , where an adult is designated as the custodian of its funds. The money in these accounts is the property of the minor but is managed by the custodian. When the minor reaches their state’s legal age of adulthood, the funds are turned over to them. The most common types of custodial accounts are known as Uniform Gift to Minors Act (UGMA) or Uniform Transfer to Minors Act (UTMA), depending on your state.

Can I afford a child?

A child will impact nearly every aspect of your life, and your finances are no exception. Here are some tips to help you along the way.

Create a budget

To get a clear idea of exactly how much everything will cost and how you can adjust your spending as you grow your family, start by creating a budget .

Housing, food and child care will likely account for the bulk of your spending. But don’t forget things like sports equipment and toys, entertainment like subscriptions or video games and personal care expenses, including haircuts and toiletries.

Be prepared for anything

Whether it’s a dental procedure, a school trip, or a new paint job when your toddler decides to “decorate” the walls, a cushion for those extra expenses comes in handy. A healthy emergency fund will help save you stress when the unexpected occurs.

Plan for the cost of a child with confidence

Parenthood is full of both responsibility and joy. You will learn a lot along the way, and managing your finances is just one crucial aspect of raising a child. With careful planning, you can begin your journey with faith in your financial future.

Read next

Money solutions and strategies sent straight to your inbox.

Tips and tools to help you build your best financial future.