What we'll cover

What APR, APY and compound interest are

How to calculate all three

Why they matter for your finances

If you’ve ever tried to compare rates on auto loans, credit cards, home loans or savings accounts, you’ve probably seen quite a few mentions of APY (annual percentage yield) and APR (annual percentage rate). But do you know what they mean? Mastering these common money terms can help you better navigate your financial future with confidence.

What is APR?

Your annual percentage rate is the total amount of interest you pay on a loan account over one year. APR often applies in situations like credit cards or auto loans and is based on the interest rate. For some loans, it may also take into account points, additional fees and other associated loan costs.

It does not factor in the frequency of compounding interest, so you may have to read a little fine print to get the most accurate idea of what you’ll pay in interest over a year. That’s because you can’t tell just by looking at the APR how often the bank will compound that interest you’re accruing.

For example, let’s say you find a loan with an APR of 8.28 percent. Just from looking at the APR, you don’t know if you’re paying 8.28 percent applied to your balance once at the end of a year, or 0.69 percent (8.28 percent divided by 12 months) on your loan balance monthly. The more frequently the rate is applied to a balance, the higher the total amount you’ll pay.

The factors that go into calculating APR vary by loan type. Credit cards generally have several different APRs for different types of transactions, like one for cash advances and one for regular purchases. APRs for mortgage loans could include insurance and closing costs. To be sure you know what you’re really paying, ask exactly what’s included in the advertised APR for the loan you’re considering.

The variables can get complicated, but the takeaway is this: The higher the APR offered for your loan account, the more interest you’ll pay.

Together APY and APR represent a more holistic way to see what you will earn (or owe) compared to looking at the interest rate on the account.

What is APY?

Annual percentage yield is the total amount of interest you earn on a deposit account over one year. APYs can be found on a CD (certificate of deposit) or a savings account, and although it’s based on the interest rate, APY takes into account the frequency of compounding interest to give you the most accurate idea of what you’ll earn in a year.

So, if you found an account that offered 5.10 percent interest compounded annually and one that paid 5.0 percent interest compounded daily, figuring out which one really paid the most would require some serious math.

If formulaic math is not your love language, you can also compare APYs. In the example above, the account that compounds daily has an APY of 5.12 percent. The one that compounds annually has an APY of 5.10 percent. (See more on how that’s calculated below.)

If you always compare APYs on deposit accounts, you can be sure you’re comparing apples to apples. Banks are required to display their APYs anyway. All you really need to know is that the higher the APY, the faster your balance grows.

Calculating APR vs. APY

If you’re up for some math, learning how to calculate these two digits can be a great way to better understand what they mean. We’ve broken down both of the formulas below. (If just thinking about serious math gives you stress hives, use our APY calculator here.)

APY = (1 + R/N) N – 1 In this formula, R represents the nominal interest rate and N is the number of compounding periods per year.

APR = (Periodic interest rate × 365) × 100 This calculation gets a little more complicated because you also have to do the math to find your periodic interest rate. That equation is: [(interest expense + total fees) / loan principal] / the number of days in your loan term.

Tip: You can also create a simple spreadsheet to do these calculations for you. This allows you to plug in different numbers and easily see how different variables affect the overall APY and APR.

Understanding compound interest

Together APY and APR represent a more holistic way to see what you will earn (or owe) compared to looking at the interest rate on the account. However, one other element you do want to keep an eye on when comparing is compound interest. Compound interest can have a significant impact on what you earn or owe. Remember, APY already takes into account compound interest, but APR does not. That doesn’t mean it’s not impacted by it.

Compound interest means interest accrues on previously accrued interest and your initial principal. Compound interest can work for or against you, depending on whether you’re earning it or paying it and how frequently it’s being compounded, whether it’s daily (like on Ally Bank deposit accounts), quarterly or yearly. Either way, the method is the same: at a given frequency, the interest gets added to the principal and begins affecting the total interest earned or paid.

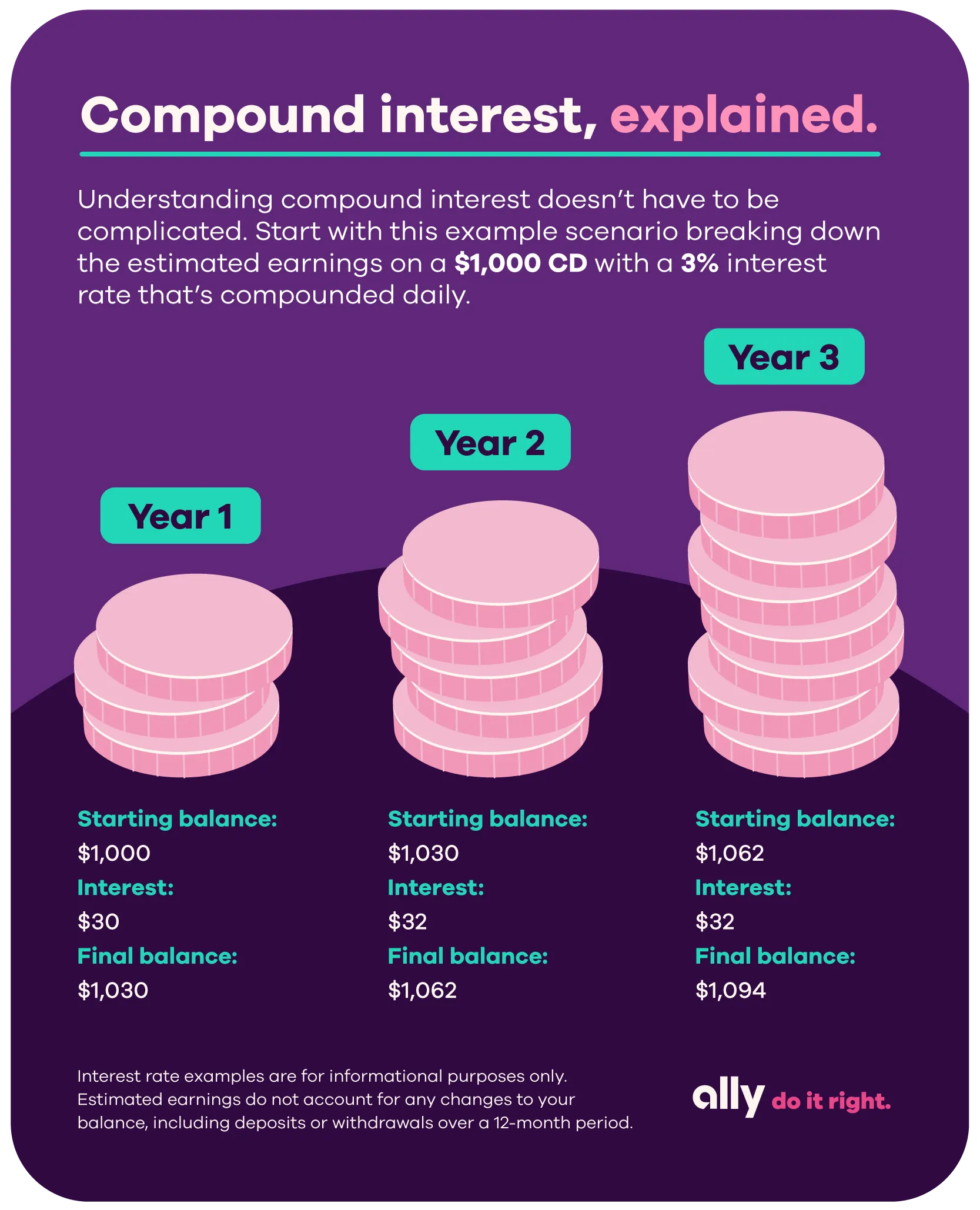

The example below shows how compound interest works on a deposit account that pays 3 percent interest compounded daily (rounded to the nearest dollar).

In this example, the amounts are small, but you get the idea. With larger deposits over a longer period of time, that compounding effect can really add up.

Remember, APY indicates the total amount of interest you could earn on an account in a year, taking into account the frequency of compounding interest. APR, however, refers to what you owe and does not reflect the frequency of compounding interest. In that case, compound interest works the other way around. The interest on your debt can add up quickly, too, so it’s important to understand how it works.

Why it’s important to understand the differences

Considering they’re only one letter apart, APR and APY couldn’t be more different. Understanding the nuances between these two very different terms can help you better map out your money future with a clear outlook on what you owe and what you earn. Remember, financial literacy is a lifelong journey. By staying curious and informed you can stay in control of your financial future.