Before online trading platforms were available, owning a stock meant possessing a physical stock certificate, and it took several days to complete a trade. The Securities and Exchange Commission (SEC) created settlement periods to allow time for buyers and sellers to physically exchange their respective halves of the trade.

While it no longer takes days to transfer money, settlement periods are still a factor in securities trading, creating the concept of unsettled funds.

What are unsettled funds?

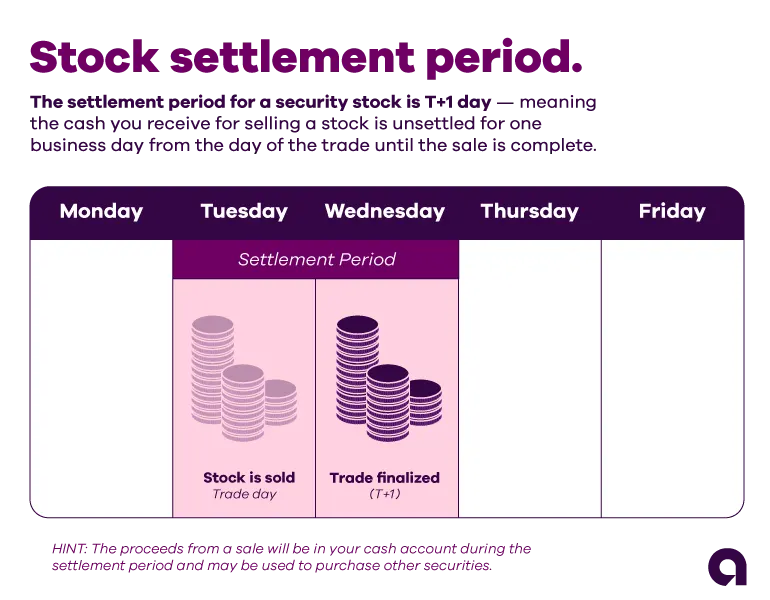

The proceeds created by selling a security are considered unsettled funds from the time you place a trade order until the end of the settlement period, when the sale is considered completed. As of May 28, 2024, stocks have a one-business-day (T+1) settlement period, so proceeds generated by selling stock in a cash account are considered unsettled for one business day following the trade date.

Read more: Get the investing guidance you need from an advisor.

What are settled funds?

After the settlement period has ended, the proceeds from the sale become settled funds. Similarly, cash you deposit or wire into your brokerage account to use for trading is considered settled. Let's look at an example:

What is a settlement period?

A settlement period is from the date the trade is executed on the market to the date on which the trade is finalized — a one-business-day period (T+1). By the end of the settlement period, a buyer must have paid for the trade completely and the seller must have delivered the security.

For example, if a stock is sold on Monday, the trade is settled on Tuesday. ETFsand option trades follow the same rules as stocks and have a T+1 settlement period.

Can you buy other securities with unsettled funds?

While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade.

Depending on your brokerage, the cash you can use to buy securities may be referred to as your “cash buying power" or “cash available to trade." It combines settled cash and unsettled proceeds.

If you purchase a security in a cash account with either insufficient funds or unsettled funds, you must hold that security until either you pay for it fully with a new deposit, or the settlement date of the trade that generated the funds for the purchase.

When you use unsettled sale proceeds to purchase another security, you agree in good faith to hold the new purchase until the funds from the original sale settle.

Read the Ally Invest Unsettled Proceeds Sales disclosure here.

Can you withdraw unsettled funds?

While you can use unsettled funds to make another purchase in a cash account, you typically cannot withdraw unsettled funds. Only when they are fully processed and settled can you withdraw the funds.

What are the settlement violations?

If you trade using unsettled funds in good faith, you should be aware of these potential settlement violations:

Cash liquidation violation: Occurs when you don't have sufficient cash to cover the cost of a trade.

Freeride violation: Occurs when you purchase a security in a cash account with insufficient funds and sell the same security before paying for it in full by the settlement date.

Good faith violation: While unsettled funds may be used to purchase a security in good faith, you cannot sell any part of the newly purchased security before the funds have settled.

Can you sell a stock before the settlement date?

The key is knowing if you bought the stock using settled or unsettled cash. If you bought it using settled cash, you can sell it at any time. But if you buy a stock with unsettled funds, selling it before the funds used to purchase have settled is a violation of Regulation T (aka a good faith violation). If you commit a violation, you'll be penalized with a 90-day restriction on your account.

Settle down and trade on

While stock trades don't require the in-person cash handoff they did in the past, settlement periods still remain. Understanding unsettled funds and how you can and cannot use them will help you keep your trades in-line.