What we'll cover

Methods to pay off student debt

How to create a student debt payoff plan

The possible avenues for payment

A college education can open up a world of opportunities for your professional and financial future. But it can also come with a very large price tag and student loans that often require years (or decades) to pay off.

If you’re one of the more than 45 million people who collectively owe more than $1.6 trillion, you probably saw the recent headlines about the student loan forgiveness plan. The decision to not cancel student debt may have come as a disappointment — but don’t panic.

While there’s no magic wand you can wave to reduce your student loan debt overnight, there are steps you can take. Start tackling your debt today with these best practices:

1. Know what you owe

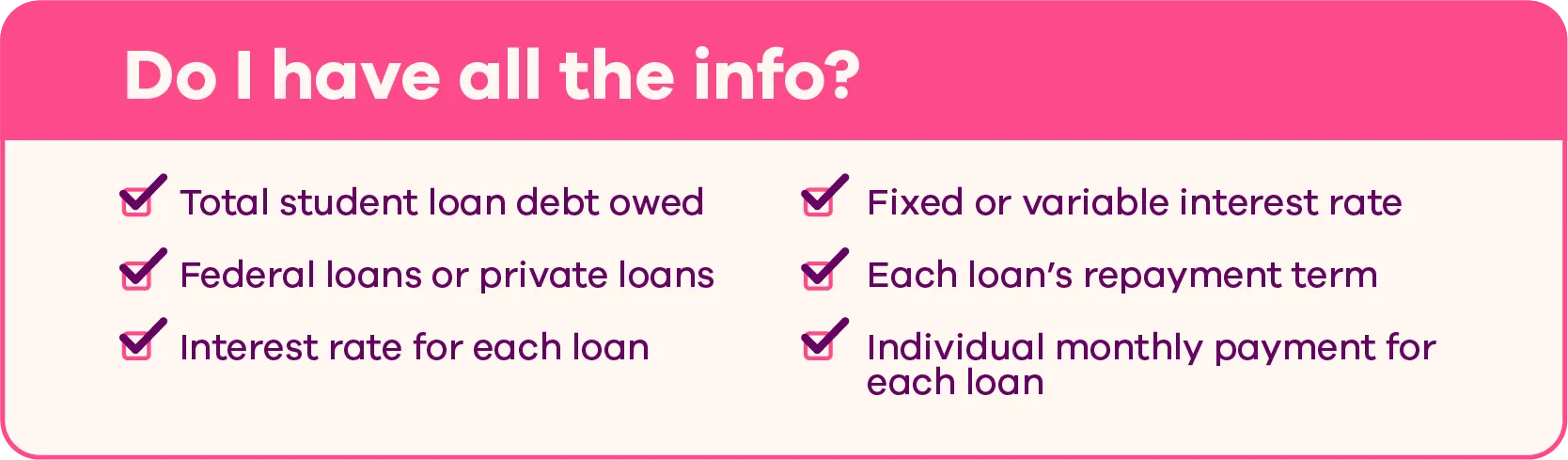

To begin, you need a holistic view of what you owe. Often, the best way to figure this out is to go to the source: your loan servicer (the company that handles the billing of your loan). They can help you determine the following:

Once you know exactly what you owe, you can move on to the next step in your student loan repayment program.

2. Determine if you can afford to make extra payments

If you don’t have a budget method in place yet, or you’re not fully committed to yours, work to create one.

As you look over your numbers, see if there are any expenses you can reduce or get rid of altogether. This leftover money can go toward your student loan payments (yes, you can pay more than the minimum amount) or be added to your savings. If you pay more than the minimum amount due each month, you’ll make progress faster and pay less interest charges.

If you’re saving, you should consider building up a small emergency fund. You can keep this money in a high-yield savings account, like Ally Bank's Savings Account, to earn a competitive interest rate. And if you have a 401(k) retirement plan at work, for example, you should save enough of your income in the plan to at least get your company match. Overall, any money you have laying around that isn’t factored into your budget or savings plan can go toward conquering your student loan debt.

Can’t squeeze an extra dime out of your budget? You could take on a part-time job, increase your hours at your current job if you’re paid hourly, angle for a promotion or pay raise. You could also look for a new position (or even make a career change) that pays a higher salary. Another option would be to start a side hustle online or work from home to make extra money.

3. Consider refinancing

If you owe multiple loans to multiple loan servicers, refinancing or consolidating them can make your debt more manageable. This streamlines your monthly payments into a single student loan payment, making it easier to keep up with your student debt. Second, and perhaps more importantly, student loan refinancing could help you lock in a lower rate on your outstanding loan balance, which means more of your payment goes to the principal each month. Bonus: You get out of student loan debt faster.

If you have both federal and private loans, think carefully before combining them. Refinancing them together into a new private loan means you lose certain protections associated with federal loans, including the ability to pause your payments temporarily through deferment or forbearance.

4. Enroll in autopay

Many federal and private student loan programs offer an interest rate discount for enrolling in automatic payments. If you have a relatively steady income and know the money will be available each month, this might be an option for you.

While the discount may only be a quarter of a point — it all adds up over time. And by paying automatically, you can also avoid late payments, which could hurt your credit score.

5. Make bimonthly payments

While not expected by loan servicers (you’re only expected to pay once per month), payments made twice a month (or even weekly) allow you to chip away faster at your outstanding balance and the interest that’s accumulating on your loan. Ask your servicer if this is an option for you.

If your lender doesn’t allow you to set up bimonthly payments using autopay, don’t worry. You can schedule your regular payment with autopay to get a rate discount, if applicable, then set up another bimonthly automatic payment from your bank account.

6. Determine the best repayment plan for your goals

Income-driven repayment plans are available for federal loan borrowers, but you might want to steer clear if your ultimate goal is paying off student loans faster. With this type of repayment plan, your monthly loan payment is tailored to fit your income. You could avoid budget strain this way, which could be good if you’re not making a lot of money yet. The downside? Your repayment term is stretched out even longer, so you end up paying more interest in the long run.

7. Use ‘found money’

Got some cash for your birthday from Grandma? Or even a tax refund? If you find yourself with an unexpected windfall, it can go a long way toward helping you pay off your student loans. Use this surplus cash to make extra payments when possible.

8. Look into forgiveness and reimbursement programs

Student loan forgiveness and reimbursement programs are the dreams of those paying off debt. Since they can have specific requirements, make sure you qualify before applying. For instance, if you’re a teacher you must teach full-time for five complete and consecutive academic years in a low-income elementary school, secondary school, or service agency, in order to be eligible for up to $17,500 worth of forgiveness.

With the Public Service Loan Forgiveness plan, you may be able to get your remaining loan balance forgiven if you pursue a career in public service and make at least 120 qualifying payments toward your loans. If you find yourself in this situation, you should think carefully about which repayment plan you opt for, since some could help you pay less out of pocket than others.

If you find yourself with an unexpected windfall, it can go a long way toward helping you pay off your student loans.

9. Factor in other debt

If you have multiple debts, you should factor those in as well when planning your budget. Include credit card balances, car loans and any other type of debt. Then you can try the snowball debt elimination method. This plan allows you to rank your debt from the lowest to highest balance and pay as much as you can toward the first (lowest) debt while paying all other minimums. With that first debt out of the way, you can roll the amount you’ve been paying over to the next outstanding amount and so on.

Put a plan into action

Paying off your student debt can be a daunting proposition. But once you’ve equipped yourself with the right tools and a solid plan, you’ll be well on your way to eliminating your debt sooner than you think.