Credit cards, when managed correctly, can help establish a strong credit score and give you flexibility with your spending. Swiping your credit card can also help earn rewards — including cash. Learn about the different ways to earn and redeem those rewards so you can decide what’s right for you and your spending habits.

How to get cash back from a credit card

Different credit cards offer different rewards programs. They may calculate your incentives based on a percentage of each purchase you make or on the total dollar amount spent. If your credit card directly offers cash back, these calculations are often fairly simple. For example, a 1% rewards rate could earn you $10 back when you spend $1,000.

But if your credit card rewards come in the form of points, the math could vary drastically. You might earn one point for every dollar spent, for instance, and redeem them at a rate of one cent per point earned. (Your credit card may also offer the option to exchange points for travel miles, shopping discounts or a gift card.)

The combination of smart spending and the right cash back credit card program will set you on the path toward maximizing the cash your earn.

What’s the difference between cash back and a cash advance?

Despite having similar names, cash back is reward money you’ve already earned, while a cash advance lets you withdraw cash against your credit limit for a fee and, most likely, a higher interest rate on payments toward the cash advance.

How to get cash from an ATM with your credit card

When you’re in a pinch and need cash quickly, you can get an advance from an ATM. The process works much the same as it would with a debit card — except for a few key details:

You will pay a fee for the cash advance itself, often around 3 to 5% of the total amount withdrawn

You may be charged an additional ATM fee for the withdrawal

You'll often be charged a higher interest fee—and interest will start accruing immediately

You’ll need your credit card’s PIN, which you can set up by calling your provider

With these additional charges in mind, cash advances are best used only in emergencies. If you’re looking for ways to earn cash from your credit cards, try sticking to rewards programs.

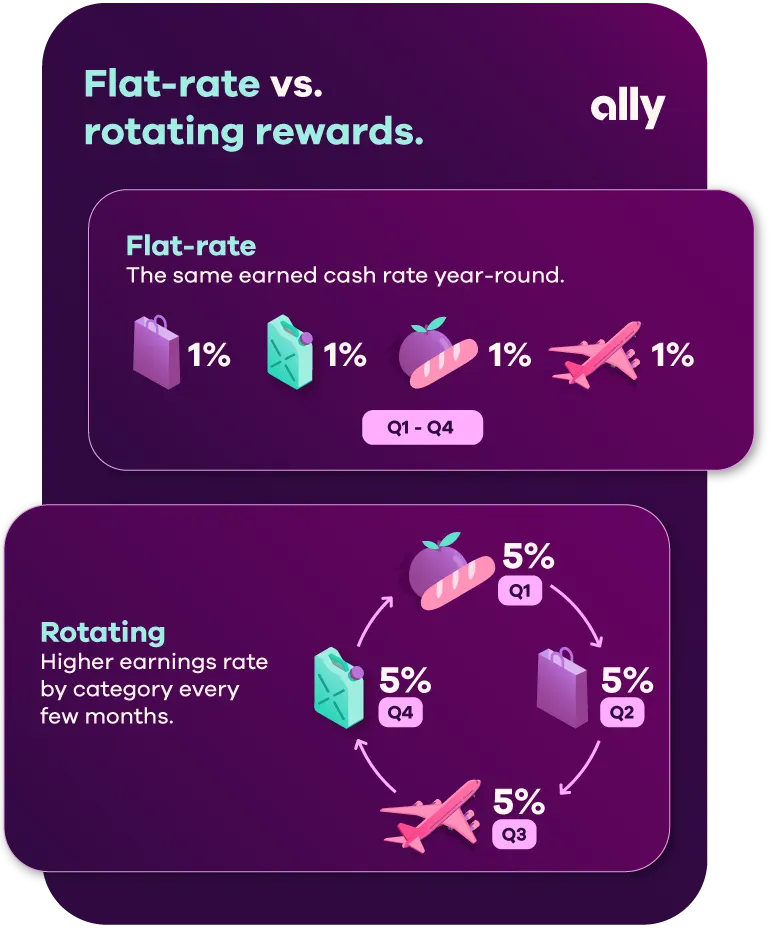

How to get cash back with a flat-rate rewards structure

A credit card with a flat-rate rewards system offers a fixed percentage of cash back on every purchase. In other words, you earn cash back at the same rate, regardless of what you purchase. If you don’t want to keep an eye on ever-changing rewards, this might be a good choice for you. A flat-rate rewards credit card can also be a good way to maximize your cash back if you spend regularly across different categories.

How to get cash back with a rotating rewards structure

Some credit card holders prefer rotating rewards, which offer higher returns on specific categories, vendors or purchases that can change based on a frequency your card issuer decides.

Rather than a 1.5% flat rate, for example, you might get up to 5% cash back on restaurants, grocery stores and gas stations one quarter, and movie theaters, car rentals and retail stores the next. These programs allow you to maximize rewards earned in the higher-rate categories.

Shopping (1%) Airfare (1%) Gas (1%) Rotating rewards - Q1: Food (5%), Q2: Shopping (5%), Q3: Airfare (5%), Q4: Gas (5%)

How to get cash back with a welcome bonus

Many credit cards offer a welcome bonus, which can involve reaching certain spending thresholds within a period to earn additional cash back. In some cases, you can get cash back just by signing up for a new credit card, but be sure to read the terms to know what you must do to earn a credit card’s welcome bonus.

How to redeem cash back rewards

Before you redeem any rewards, make sure your credit card doesn’t have a minimum earning amount. Don’t spend money outside of your typical habits just to get cash back, and keep in mind that maintaining a good credit score gives you more credit card options, letting you choose the one with the highest cash back offer.

You can decide how you want to receive the cash back: as a statement credit, as a check or as a direct deposit into a checking account.

Make the most of your credit

The combination of smart spending and the right cash back credit card program will set you on the path toward maximizing the cash you earn. And who doesn’t like a little extra money?