What we'll cover

What a 50/30/20 budget is

How to create a 50/30/20 budget

How to categorize your expenses

If you're new to budgeting, it's easy to get overwhelmed by visions of spreadsheets and pivot tables.

But there's more than one way to budget. Instead of diving into the deep end, start with a simpler approach: 50/30/20. It's easy to set up and maintain, helping you to achieve your financial goals.

What exactly is a 50/30/20 budget?

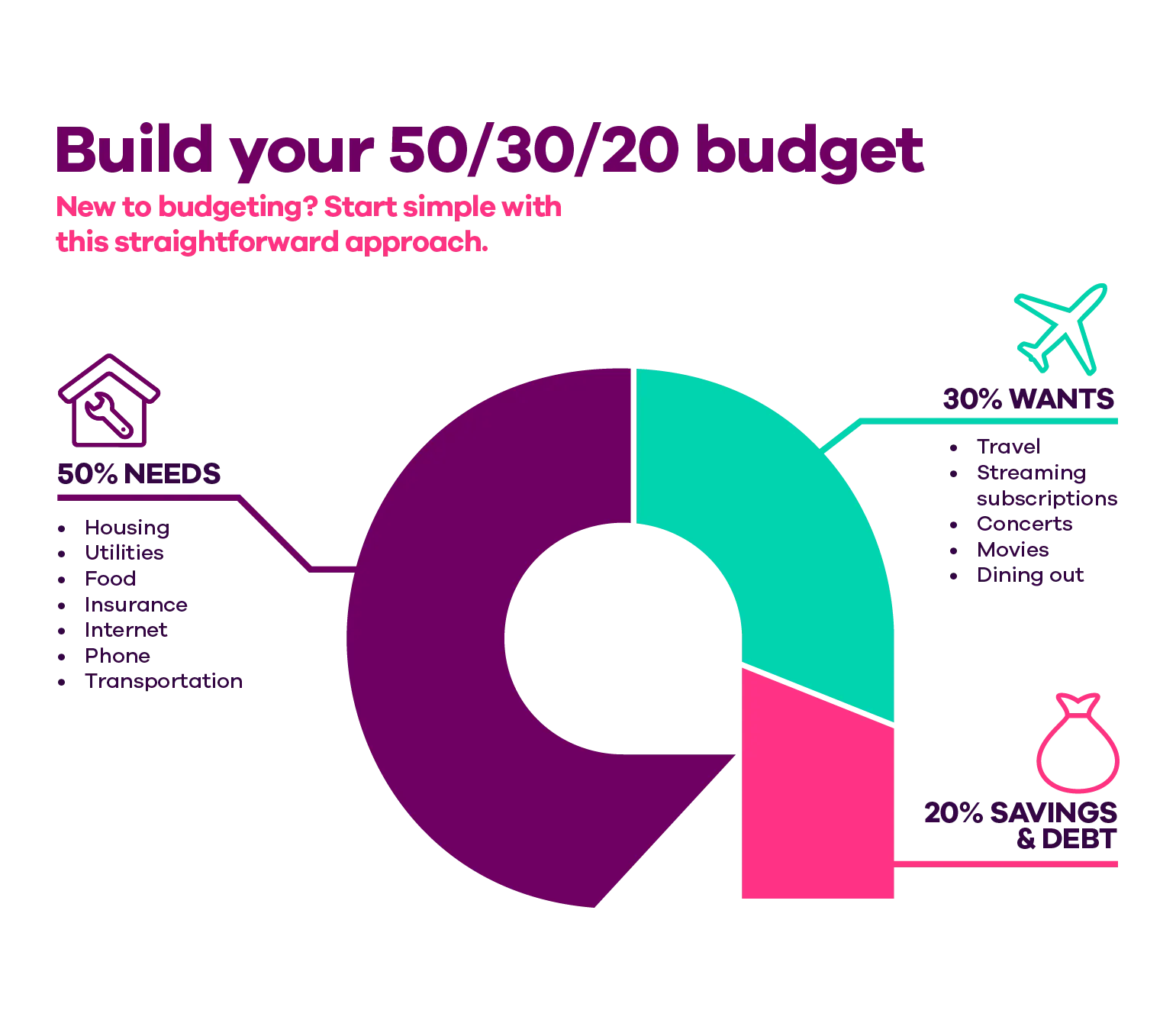

A 50/30/20 budget (sometimes called the 50/30/20 rule) divides all your expenses into three categories: needs, wants and savings/debt. To divvy up your after-tax monthly income:

50% goes to needs

30% to wants

20% to savings and debt repayment

This approach to budgeting is perfect for those new to personal finance because it's easy to understand and follow. The biggest question most people have when creating a budget is whether they're spending too much on an item. Rather than fretting about how much you spend on, say, gas or coffee, this system allows you to create a general spending structure without being super specific.

Read more: How to use buckets to organize your savings in an Ally Bank Savings Account

How to build a 50/30/20 budget

You can set up this budgeting method in a spreadsheet, in your notes app, on pen and paper or you can use our free template.

The only thing that really matters is to properly categorize your spending beforehand. That can be as easy as taking these three steps:

Step one: Record your monthly net income. This is the total amount you'll be distributing between needs and expenses.

Step two: Write down your expenses, categorizing them as wants or needs. The goal is to have these account for 30 and 50 percent of your income.

Step three: Put what's left toward your savings and paying down debt.

Only you can decide if your weekly sushi is a need or a want. Try to be honest with yourself.

As you begin to track your expenses, you'll quickly notice if you're adhering to your guidelines or if adjustments are necessary. Where is the bulk of your money going? Are you able to save or are you splurging on takeout every week? This system allows you to quickly spot specific problem areas and adjust accordingly.

What counts as a want?

Certain expenditures, such as concert tickets, streaming services and sporting events clearly fall into the realm of wants. Essential needs, on the other hand, encompass items such as groceries. However, some expenses blur the lines. Is dining out or subscribing to a meal prep service a need or want? The answer isn't always straightforward. Only you can determine if your weekly sushi is truly essential or just a desire.

Being truthful with yourself is key. If you misclassify numerous wants as needs, you might encounter difficulties when it comes to covering crucial expenses like rent and utilities.

Ally Spending and Saving Buckets can help you get organized with building toward your financial wants and needs by automatically categorizing your income for specific goals.

What if my debt and savings is more than 20 percent?

Even if you're being financially responsible, it's possible for your debt/saving category to exceed 20 percent. Perhaps you're saving more than 20 percent of your after-tax monthly income for retirement, an emergency fund and other goals. Or maybe your outstanding debt requires payments that account for more than 20 percent.

If you're a super saver and socking away more than 20 percent, don't worry about your budget not adhering to the target. But if your debt is more than 20 percent, you should examine where it's coming from.

Take some time to review your debt and see if you can repay it faster than expected. (Maybe you can reallocate some of the money you spend on wants towards debt repayment.) You can also try to refinance the debt to get a lower interest rate. Debt consolidation might also be an option for you.

Read more: Find a debt repayment strategy that works for you.

Build your budget skills

Introducing new financial habits into your routine can be intimidating, but practice makes perfect. Once you've mastered the 50/30/20 budgeting method, you might decide to start using a more complicated system — or not. The beauty of this budgeting philosophy is that it allows for detailed analysis but doesn't require it for you — and your spending — to stay on track.