Diving into investing can be intimidating. But don’t let trying to figure out where to begin keep you from getting started. Instead of getting bogged down in all the details of investing, first try learning more about the foundation of many portfolios: exchange-traded funds, often known as ETFs.

What are exchange-traded funds?

ETFs pool together the money of many investors to invest in a basket of securities that can include stocks, bonds and commodities. When you invest in one ETF, you're exposed to all the underlying securities held by that fund (which can be hundreds).

How ETFs work

ETFs are easily traded on the stock exchange and are bought and sold throughout the trading day. This means the price of an ETF share can fluctuate above or below its net asset value based on supply and demand — just like a stock. Many ETFs also pay dividends, but these payments are not guaranteed.

Read more: Want to start investing? Explore these 4 basic concepts for beginner investors.

ETFs are typically passively managed. Instead of having a portfolio manager select specific securities to buy and sell, ETFs attempt to replicate the performance of a specific index like the Dow Jones Industrial Average and hold a collection of securities from that index. Or it might track an industry like biotechnology by containing stocks from a range of companies within that sector.

ETFs vs. mutual funds

ETFs and mutual funds both allow you to invest in a diverse portfolio of securities, but they each have different investment objectives. If you want to make your own trades and likely incur fewer expenses (if you were to choose passively managed ETFs over actively managed mutual funds), you may want to consider ETFs. However, if you prefer a portfolio manager overseeing your investments, mutual funds may be more appropriate.

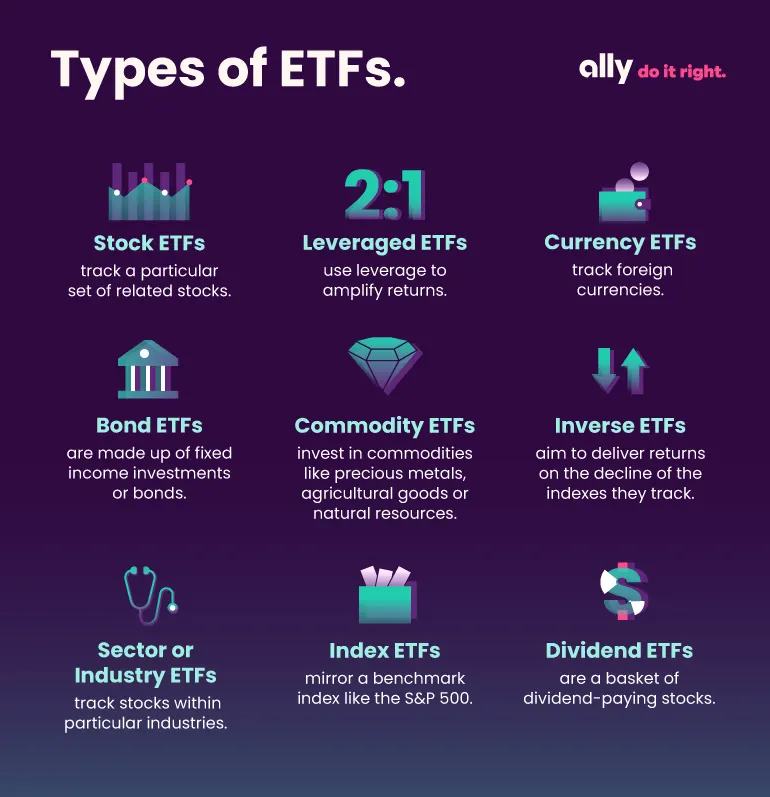

Several types of ETFs exist, all with different performances and varying levels of associated risk.

ETFs vs. stocks

Because a stock is an investment in one publicly traded company, its volatility isn’t buffered by the diverse securities held in an ETF. Although holding a single stock may outperform an ETF with that stock in its holdings, this typically owning just one a stock is typically a riskier investment choice, although holding a single stock may outperform an ETF that contains that same stock. Because ETFs are inherently diversified, if one underlying security underperforms, the others may buffer its performance. An ETF also exposes you to many securities with only one purchase, while you would need to make multiple stock purchases to diversify your portfolio. If your brokerage charges commissions, each purchase may cost you a fee.

What kinds of ETFs can you invest in?

Several types of ETFs exist, all with different performances and varying levels of associated risk. It's important to evaluate any ETF you're considering as an investment. Here’s a list to get started:

How to evaluate an ETF

When considering an ETF, note the following factors and other details. None of these will guarantee success, but they’ll help you get a full picture before investing:

Costs: Review any maintenance fees or other associated costs.

Investment objectives: Check on investment objectives, risks, charges and expenses, which are included in the fund’s prospectus

The index it tracks: Understand what the index consists of and what rules it follows in selecting and weighting the securities in it

Length of time: Look at how long the fund and/or its underlying index have existed and how both have performed over time

Expense ratio: Assess the annual cost of owning the ETF

Taxes: Depending on what it invests in and how the ETF is structured, returns may be taxed in a variety of ways

Management: Check into the management team's experience and track record. You may want to consider talking with an investment professional to decide whether an ETF makes sense for your goals and timeline.

How do you invest in ETFs?

To start investing in ETFs, you’ll need a brokerage account. You can purchase commission-free ETFs through Ally Invest's Self-Directed Trading account and buy after conducting your own research. Or, if you’d like a more hands-off approach to investing, select an Ally Invest Robo Portfolio, which is primarily built on ETFs.

ETFs and your portfolio

Now that you've got a grasp on exchange-traded funds, you can start evaluating whether or not they're a good fit for your portfolio. A good starting place is to examine your current portfolio's diversification. From there, you can research ETFs that fill any gaps in your portfolio. With a strong understanding of your own investment needs, you can feel confident when investing in ETFs for the first time.