What we'll cover

Why FDIC insurance is important

How FDIC insurance works

Options for depositors to insure excess funds

You insure your home, health and cars to protect your more valuable possessions. But what about your money? Ally Bank is a member of the Federal Deposit Insurance Corporation (FDIC), and we'll walk through how that impacts you as an Ally Bank customer.

Introduced in 1933 during the Great Depression, the FDIC continues to serve as a way to insure Americans’ bank deposits in case of bank failure — ultimately guaranteeing the money stays in their possession.

As an Ally Bank customer, your deposits are FDIC-insuredup to the maximum allowed by law. What does that mean for you and your finances? Here’s what you need to know.

How does FDIC coverage work?

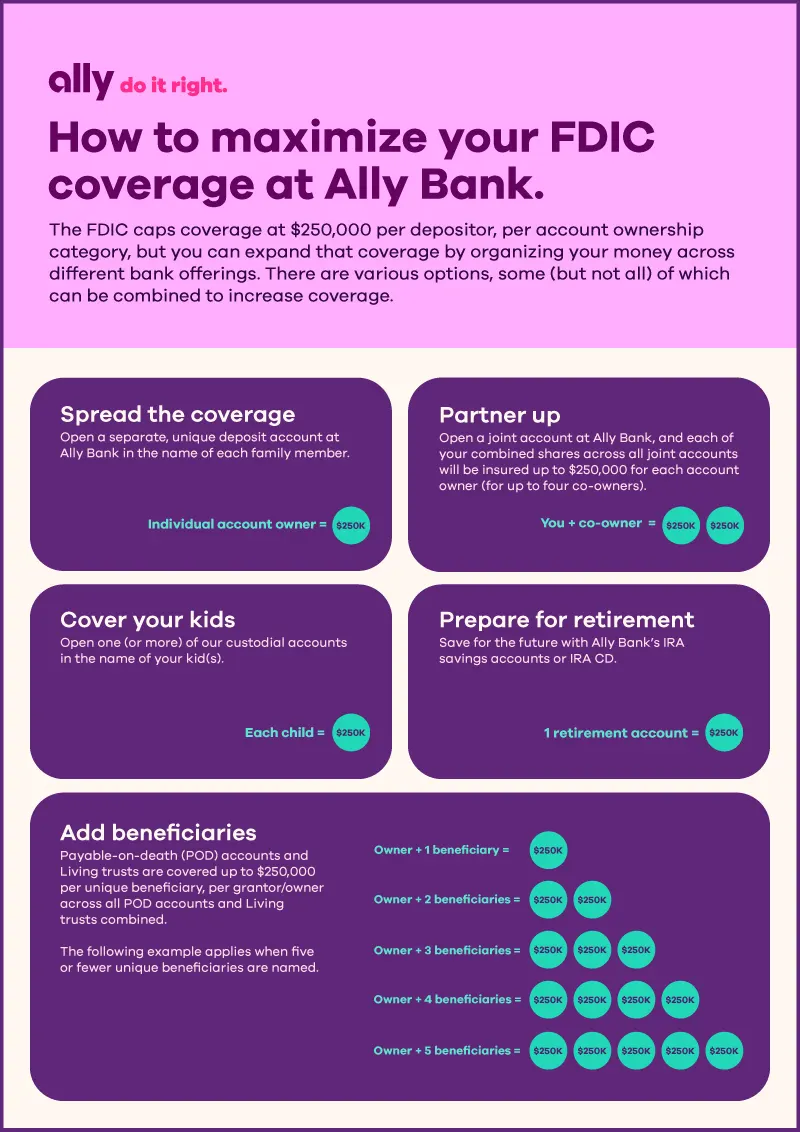

Money in an FDIC-insured bank, such as Ally Bank, is covered up to $250,000 (including principal and interest) per depositor, per qualifying account ownership category — but you could very well qualify for more than $250,000 in coverage if you mix and match accounts in different categories. (Examples of ownership categories include single accounts, joint accounts, retirement accounts, custodial accounts and trusts.).

The FDIC insures traditional deposit accounts, such as Ally Bank checking accounts, savings accounts, individual retirement accounts (IRAs) and money market deposit accounts, as well as certificates of deposit (CD), cashier’s checks, money orders and other items issued by a bank. It does not insure investment products like stocks, bonds, mutual funds, annuities or life insurance policies.

How to insure excess deposits at Ally Bank

You may be asking yourself: What do I do if I have more than $250,000?

Good news — there are a number of ways you can expand your FDIC coverage beyond $250,000. It will take a little extra organization between different categories — but it’s well worth it to get the coverage you need.

You have options to maximize your coverage at Ally Bank:

Note: The rules for all trusts (including revocable trusts) apply through March 31, 2024, when new rules will go into effect. Learn more about these changes on the FDIC's website.

Explore other ways to maximize coverage

Beyond the types of accounts at Ally Bank, the FDIC also insures other less common account types up to $250,000, including:

Corporation, partnership or unincorporated association accounts: Many business accounts are protected by FDIC, but keep in mind accounts of a sole proprietorship or Doing Business As (DBA) are not insured under this category.

Employee benefit plan accounts: Some employers offer employee welfare or pension benefit plans that are insured by FDIC.

Education savings: Accounts like Coverdell education savings accounts are insured as irrevocable trusts by the FDIC.

Government accounts: If you have access to an account owned by the federal government, state governments and certain other governmental bodies, you’re covered.

Your financial future is in good hands

Thanks to FDIC coverage and a variety of digital banking options, Ally Bank customers can be confident knowing their money is protected up to the maximum allowed by law. With all the cash you’ve worked so hard to save properly insured, you can rest easy in the present and secure a successful financial future.