Spending Account

Make everyday banking count.

% Less than $15,000 minimum daily balance

Everything you expect from a checking account, and then some.

We reward you for banking with us, not the other way around.

-

Get your money up to 2 days early when you set up direct deposit

-

Go fee-free with no monthly maintenance or overdraft fees

-

Access 43,000+ no-fee Allpoint® ATMs ; we reimburse up to $10 per statement cycle for fees charged at other ATMs nationwide

-

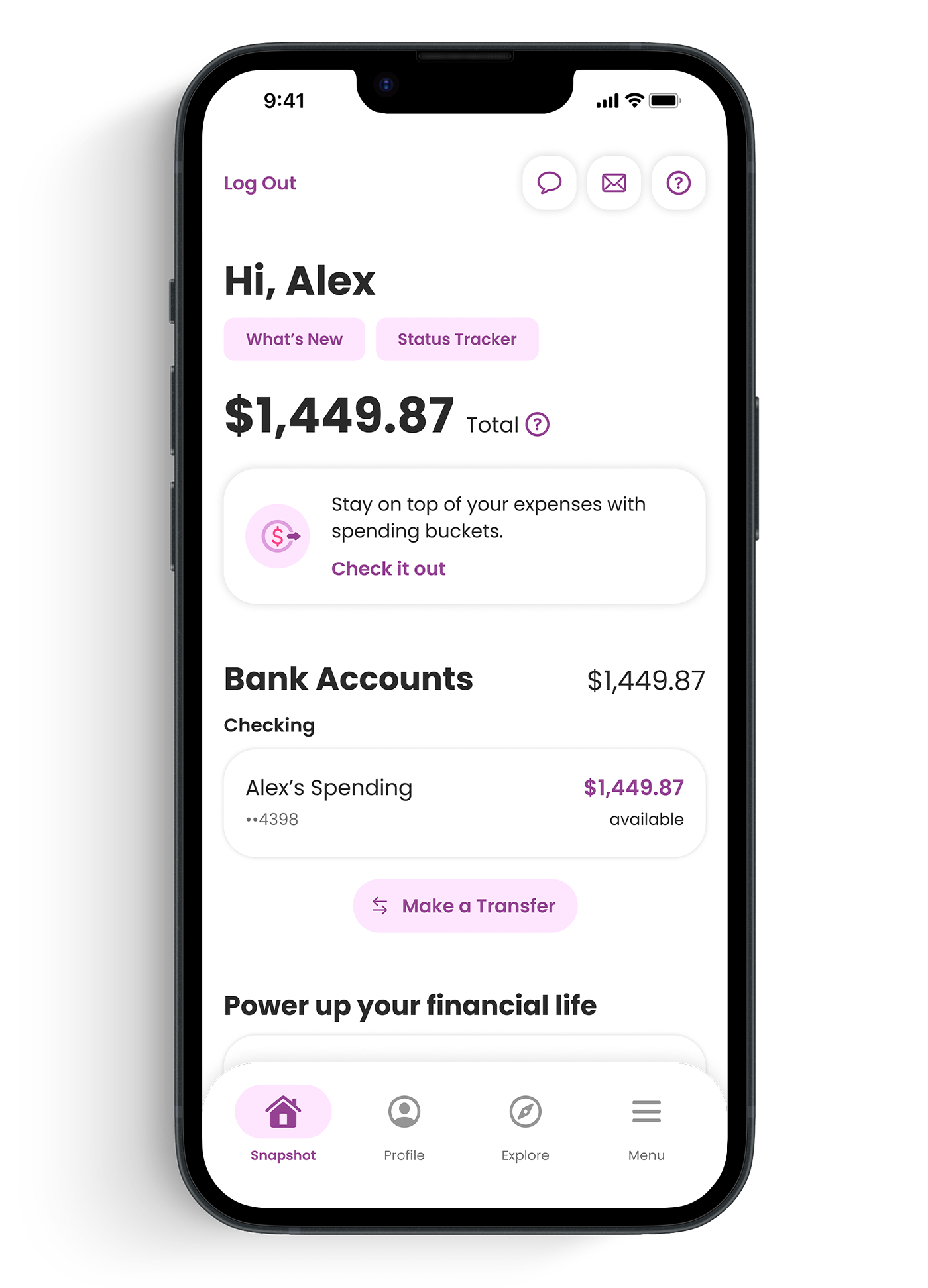

Stop guessing and stay ahead of expenses with spending buckets

-

Protect against accidental overspending with a double line of defense using Overdraft Transfer Service and CoverDraft℠ service

The cash is in the bag (or bucket).

Like digital envelopes, spending buckets set money aside for ongoing expenses like rent and groceries.

Similar to our popular savings buckets , they give you a clearer picture of your spending habits – and an opportunity to create better ones.

Our Spending Account is made for wherever you are.

Your money, FDIC-insured.

Deposits are insured by the FDIC up to the maximum allowed by law.

Manage your debit card.

Lock, set notifications, and limit your spending within our mobile app.

Deposit checks remotely with Ally eCheck DepositSM.

All you need is your smartphone and the check. Take a photo and you’re all set.

Send and receive money – no extra app needed.

Use Zelle® for a fast, safe, and easy way to pay your friends and family.

Fees, a short story.

You shouldn't be nickel and dimed for using your own money.

There's a lot we don't charge for

-

Monthly maintenance fees

-

Overdraft item fees

-

Low daily balance fees

-

Incoming wires (domestic and international)

...and we won't hide the fees we do have.

-

Expedited delivery

$15

-

Outgoing domestic wires

$20

-

$25

per hour

Get to know every aspect of this account before you sign up.

Check out our Straight Talk Product Guide (PDF).

Get more for your money.

Compare the cost of banking somewhere else.

What you should know.

Our Annual Percentage Yields (APYs) are accurate as of . Keep in mind, these rates are variable and may change after the account is open. Fees may reduce earnings. The APYs for other banks are provided by mybanktracker.com and are accurate as of . The APYs in this table are for the state of California.

A tier is a range of account balances.

Ally Bank Spending Account balance tiers:

-

Less than $15,000 = 0.10% Annual Percentage Yield (APY)

-

$15,000 or more = 0.25% Annual Percentage Yield (APY)

Bank better, starting now.

Get your account up and running in minutes.

Tell us about yourself.

We’ll need some personal info, like your address and Social Security number.

Add money to your account.

The faster you fund, the sooner you’ll earn interest. No minimum deposit required.

Enjoy our award-winning experience.

Start exploring (and enjoying) everything we have to offer.

The reviews are in.

People like it here. We think you will, too.

Average Rating

MOST HELPFUL

MOST RECENT

HIGHEST RATING

FAQs

We have answers.

Still have questions? Visit our Help Center.