Ally Bank Spending Account

It’s a checking account, but better.

No monthly fees, more money to work with.

With no monthly maintenance fees, you can spend more on what matters to you. No conditions, no catches — just straightforward access to your money.

A checking account that puts you first.

Keep more of your money.

No monthly maintenance fees, overdraft fees, or minimum balance to earn interest.

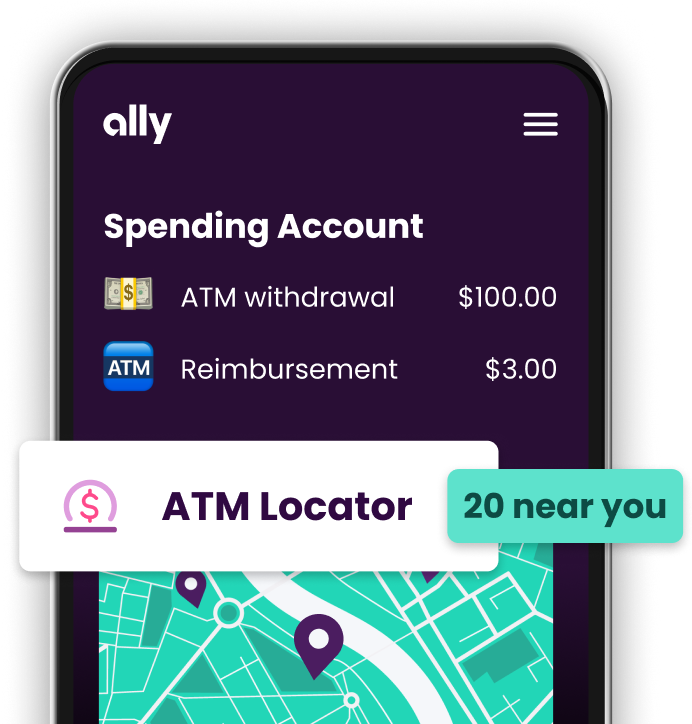

No branch, no problem.

Access 75,000+ no-fee ATMs , pay friends (or bills) online and take comfort in 24/7 human support.

Security, always on our mind.

Get alerts for suspicious activity and your money FDIC insured up to the maximum allowed by law.

We’ve got you covered.

-

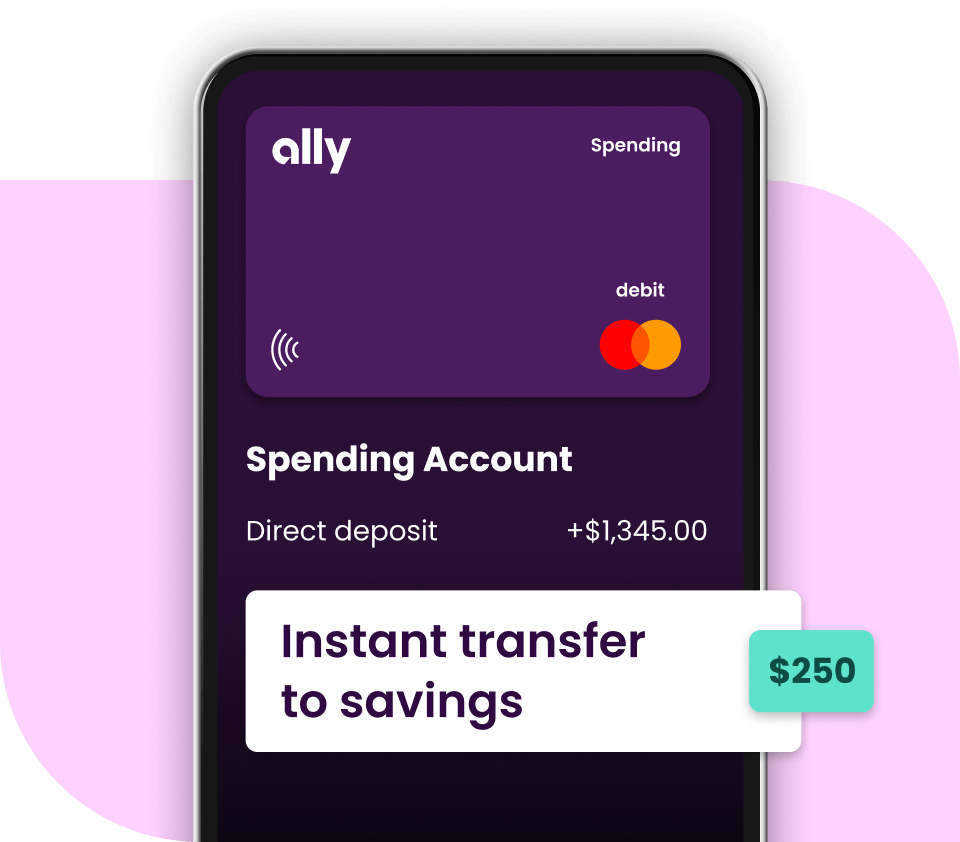

Say hello to early paydays.

Set up direct deposit in a few taps and get paid up to 2 days early.

-

Get reimbursed for ATM fees.

Far from a no-fee ATM? Receive up to $10 per statement cycle for fees charged at other ATMs nationwide.

-

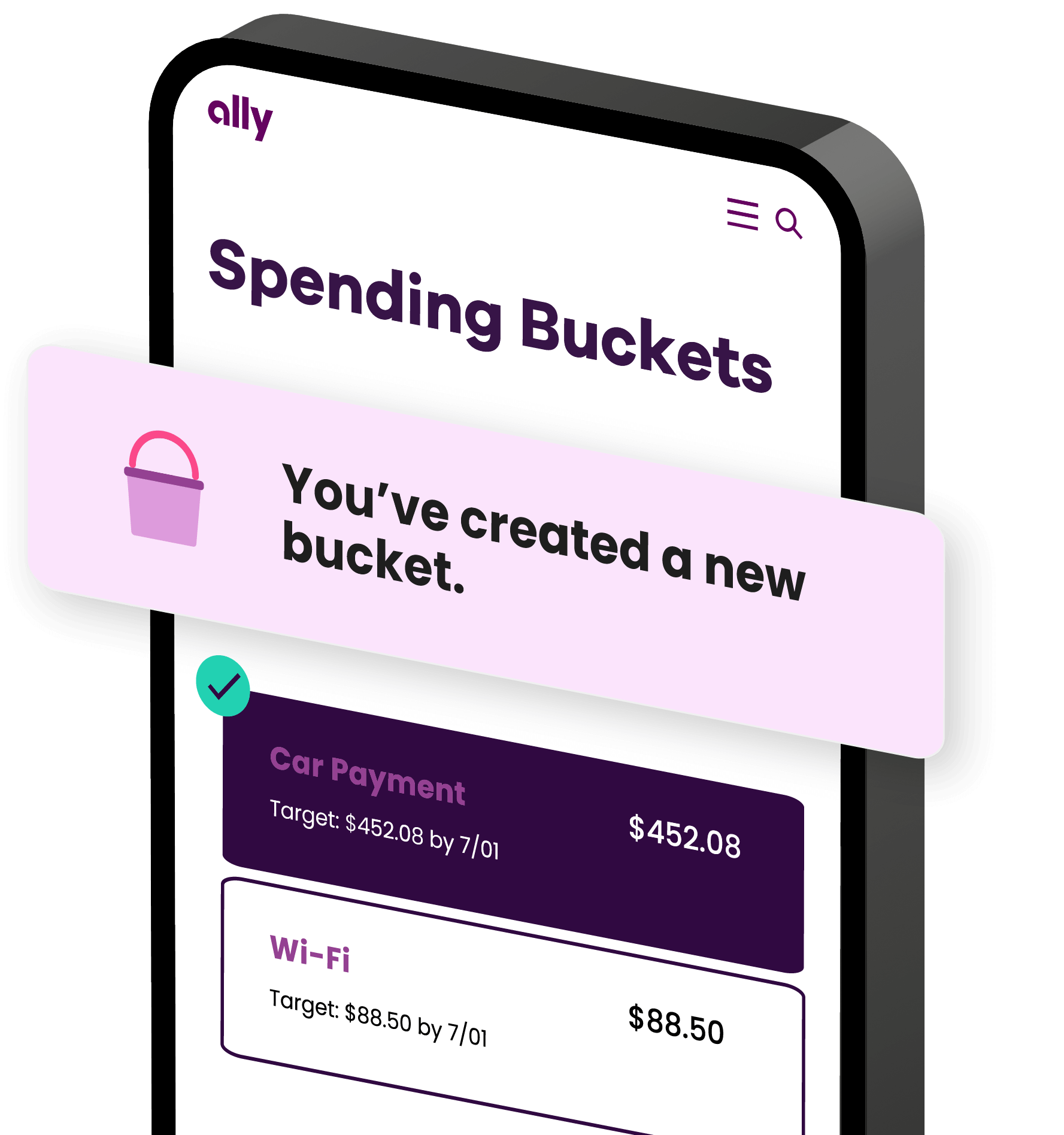

Protect against overspending.

Have a double line of defense using Overdraft Transfer Service and Coverdraft℠.

Zoom in with smart tools.

Bring your finances into sharper focus with the tools built right into your account.

Trust through transparency.

Giving you the full picture of where your money goes.

| There’s a lot we don’t charge for | |

| Monthly maintenance | $0 |

| Overdraft items | $0 |

| Low daily balance | $0 |

| Standard checks and debit cards | $0 |

| Deposit slips and prepaid envelopes | $0 |

| Standard or expedited transfers | $0 |

| ...and we won’t hide the fees we do have. | |

| Expedited delivery for debit cards |

$15 |

| Outgoing domestic wires |

$20 |

| Stop payment | $15 |

| Overnight bill pay |

$14.95 |

| Same-day bill pay |

$9.95 |

| International transactions |

Up to 1% |

Get more for your money.

Find out how our rates stack up with other checking accounts.

Ally Bank Spending Account balance tiers :

Less than $15,000 = 0.10% Annual Percentage Yield (APY)

$15,000 or more = 0.25% Annual Percentage Yield (APY)

What you should know.

No minimum deposit required to open an account.

Our Annual Percentage Yields (APYs) are accurate as of . Keep in mind, these rates are variable and may change after the account is open. Fees may reduce earnings. The APYs for other banks are provided by mybanktracker.com and are accurate as of . The APYs in this table are for the state of California.

Get to know every aspect of this account before you sign up.

Check out our Straight Talk Product Guide (PDF).

Bank better, starting now.

Get your account up and running in minutes.

Tell us about yourself.

We’ll need some personal info, like your address and Social Security number.

Add money to your account and receive your free debit card.

The faster you fund, the sooner you’ll earn interest and get your debit card.

Enjoy all the perks.

Start exploring everything our Spending Account has to offer.

Stay on-the-go with our app.

Your card, always in your control.

Lock your card in seconds if it’s lost or stolen.

Deposit checks whenever, wherever.

All you need is your phone and the check. Take a photo and you’re all set.

Send and receive money with a few taps.

Use Zelle® for a fast, safe, and easy way to pay your friends and family.

The reviews are in.

People like it here. We think you will, too.

Average Rating

MOST HELPFUL

MOST RECENT

HIGHEST RATING

FAQs

You have questions. We have answers.

Still have questions? Visit our Help Center.