Savings Account

Save smarter for what matters most.

Annual Percentage Yield

%

on all balance tiers

Finally a savings account that lets your money work smarter.

Along with a competitive, variable rate and no monthly maintenance fees, the Ally Bank Savings Account comes with tools to help grow your money faster. We found people have saved, on average, 2x more when they’ve used our smart savings tools.

-

Use savings buckets to organize your money and visualize what you’re saving for

-

Set up boosters to optimize and maximize your savings, even if the rate changes after you open the account

-

Make changes as new priorities arise

-

Get personalized recommendations to help you save more

Organize using buckets.

Set money aside for what matters to you. All in one place.

Divvy up your savings without multiple bank accounts or hard math.

Like digital envelopes, savings buckets stash your cash for whatever you want (or want to do). Use them to track your progress, all while earning interest on your total balance. Then, carry that organizational savvy into your spending using our spending buckets .

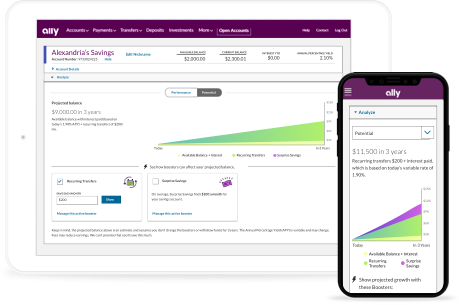

Optimize with boosters.

Accelerate your savings and put part of your strategy on autopilot.

Recurring Transfers

Set it and forget it. Move money into your savings on a schedule that makes sense for you.

Round Ups

We track your spending accounts with us for transactions we can round up to the nearest dollar. When you accrue at least $5 in round ups, we transfer it to your savings.

Surprise Savings

We analyze your linked checking accounts for safe-to-save money, then transfer it to your savings so you don’t have to.

Come for the helpful tools. Stay for everything else.

No monthly maintenance fees or minimum balance requirements.

Keep in mind, with this type of account there’s a limit of 10 withdrawals per statement cycle.

Your money earns money with interest compounded daily .

Rate is variable and may change after the account is opened. Deposits are insured by the FDIC up to the maximum allowed by law.

Earn more than 5x the national average.

The national average for this type of account is 0.46% APY, based on rates published in the FDIC Monthly National Rates and Rate Caps accurate as of 4/15/2024.

24/7 support.

Call, chat or email us any time. A real person is always available to help, day or night.

Direct deposit is a breeze

Let us prefill your form so you can focus on growing your savings.

See how we compare.

Our features maximize the way you save. Take a look for yourself.

Savings Account

monthly maintenance fees

$0

minimum opening deposit

$0

Tool to organize your savings—no additional account required:

Yes - Buckets

Tool to analyze any linked checking account for safe-to-save money:

Yes - Surprise Savings

Annual Percentage Yield

%

Advantage Savings

monthly maintenance fees

$8

minimum opening deposit

$100

Tool to organize your savings—no additional account required:

Yes

Tool to analyze any linked checking account for safe-to-save money:

No

Annual Percentage Yield

%

Chase SavingsSM

monthly maintenance fees

$5

minimum opening deposit

$0

Tool to organize your savings—no additional account required:

No

Tool to analyze any linked checking account for safe-to-save money:

No

Annual Percentage Yield

%

Way2Save® Savings

monthly maintenance fees

$5

minimum opening deposit

$25

Tool to organize your savings—no additional account required:

No

Tool to analyze any linked checking account for safe-to-save money:

No

Annual Percentage Yield

%

What you should know.

Our features information is accurate as of 4/15/2024.

Banks with maintenance fees often offer more than one condition, one of which you may be able to satisfy, to waive the fee or fees.

Our Annual Percentage Yields (APYs) are accurate as of . Keep in mind, these rates are variable and may change after the account is open. Fees may reduce earnings. The APYs for other banks are provided by mybanktracker.com and are accurate as of . The APYs in this table are for the state of California and based on a minimum daily balance of $5,000.

Ally Bank Savings Accounts have a range of account balances called balance tiers. We’re required to tell you the APY we pay is based on the tier in which your end-of-day balance falls. The APY may remain the same for all balance tiers or change based on your account’s daily balance.

That being said, we’ve simply made the current APY available across all our balance tiers.

Ally Bank Savings Account balance tiers:

-

Less than $5,000

-

Between $5,000 and $24,999.99

-

$25,000 or more

The APY we pay is based on the tier in which your end-of-day balance falls. APYs are variable and subject to change.

The APY of our Savings Account is more than 5x the national average of 0.46% APY, based on the national average of savings accounts rates published in the FDIC Monthly National Rates and Rate Caps accurate as of 4/15/2024.

Fees, a short story.

You shouldn't be nickel and dimed for using your own money.

There's a lot we don't charge for

-

Monthly maintenance fees

$0

-

Overdraft item fees

$0

-

Incoming wires (domestic and international)

$0

-

$0

...and we won't hide the fees we do have.

-

Expedited delivery

$15

-

Outgoing domestic wires

$20

-

$25

per hour

Get to know every aspect of this account before you sign up.

Check out our Straight Talk Product Guide (PDF).

Bank better, starting now.

Get your account up and running in minutes.

Tell us about yourself.

We’ll need some personal info, like your address and Social Security number.

Add money to your account.

The faster you fund, the sooner you’ll earn interest. No minimum deposit required.

Enjoy our award-winning experience.

Start exploring (and enjoying) everything we have to offer.

The reviews are in.

People like it here. We think you will, too.

Average Rating

MOST HELPFUL

MOST RECENT

HIGHEST RATING

FAQs

We have answers.

Still have questions? Visit our Help Center .